The words are printed in headlines across the world, in fresh black ink: Greece’s Economy Collapsing, Fears of Euro Zone Collapse Mount. Since the economic crash in 2008 in America, we’ve come to be intimately familiar with these words and their heavy implications. But perhaps we don’t understand the full import of these words: not only are many people only vaguely aware of the Euro Zone crisis, but may have misunderstood their significance as affecting merely countries heavily in debt.

Greece exemplifies a larger problem: its fall could cause a domino effect on the Euro Zone and destabilize other countries in Europe. Not only could it significantly affect the Euro Zone, however, but also the effects of such economic collapse would reverberate across America as well.

“This is a serious issue,” Young Song, junior at LACES high school, stated. “There’s a reason why this is on the news so much. There’s a reason why there’s talk from other countries in the Euro Zone of bailing out the euro. There’s talk about even isolating Greece and changing the currency for different countries for a reason. This is a potentially huge issue and it could really blow up for everyone.”

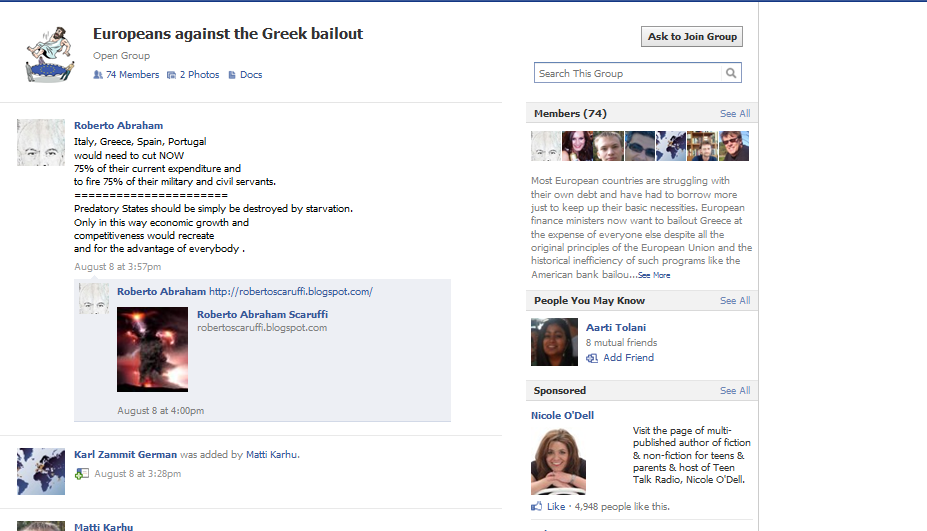

Germany and France have recently entered talks to bail out the euro, European currency, under the condition that Greece, and other such failing countries, would be forced to follow austerity plans, an action that Greece has vehemently disagreed to. Talks over this issue have broken down, with Greek citizens largely expressing discontent with the austerity plans, which include foreign monitoring of the financial affairs of countries needing aid.

“Everything’s going to change,” Michelle Li, LACES sophomore, stated. “In the end, majority opinion will win. That’s all we can do about it.”

Although Italy has accepted tightened monitoring of its financial affairs, many other countries in crisis are currently not as enthusiastic about the conditions to the economic bailout, a situation that has drastically affected Germany’s and France’s ability to counter the current euro crisis.

“There’s a lack of efficiency because countries like Greece believe that their freedom is being infringed upon,” Song explained. “But this is really problematic because this doesn’t affect just Greece. This affects everyone in the Euro Zone and us, too.”

Subtle effects of problems in the Euro Zone have made their way to America: the stock markets have fluctuated dramatically as investors have expressed concerns over the euro’s collapse. Not only will the stock markets be significantly affected, however, but many companies tied to countries in the Euro Zone will be expected to crash.

“The reason why the stock markets crashed this summer was because investors took back stocks from companies that they thought could be affected by the fragile Greek economy,” Song said. “This shows us that there’ll be a direct impact on us, if we ignore this crisis.”

In addition, experts have predicted that if the Euro Zone collapses, the world economy and markets would significantly be altered, as European countries make up a significant portion of both. With the collapse of the Euro Zone, experts fear, the world economy could take a turn for the worse.

“This is why this is important for us,” Song said. “But so many people don’t seem to understand this: they look at the Greek economy and they think, ‘geez, that could be us.’ People in my community have expressed worries, of course: they draw out from stock markets and they speculate about the economy. But they don’t think we should be involved. Kids at my school don’t really know about this. They don’t understand that it will be us if things keep up the way they have. And this is a serious problem.”